The final: Magic Formula Europe stocks Part 5

Thermador Groupe SA, Sto SE & Co. KGaA, Zehnder Group AG, FORTEC Electronik AG, Laboratorios Farmaceuticos Rovi S.A., CEWE Stiftung & Co. KGaA, Brodrene AO Johansen A/S, Computacenter Plc, Washtec AG

Hello fellow value investor,

here we go with the last batch of European companies that I found using Joel Greenblatts magic formula screener.

Thermador Groupe SA

Market Cap (MM) 777,22 €

Enterprise Value (MM) 814,51 €

LTM ROIC 21,7 %

LTM EV/EBIT 9,53x

Thermador is a french distributor of heating, plumbing, pumping and electrical equipment that connects more than 800 suppliers to DIY stores, wholesalers and professionals. They create value because they can deliver market share for suppliers and good prices and availability to customers, so a win-win if executed well. As I was looking at the company and their latest annual report, I was impressed how clearly they communicate the business model and their value proposition. I can now better understand, why a distributor can have a moat and creates real value:

The numbers clearly show that they are doing something right, and the stock was a big success story so far:

Since IPO in 2006, the stock returned 7,8% plus dividends, so one can expect about 10% annually. As a distributor, they depend heavily on the cyclical construction industry and are struggling at the moment. Revenue is stagnant LTM, without consolidating the latest acquisition of DPI, revenue declined -1,8% in 2023 YoY. Nothing alarming, more a sign of resilience, but at the moment, there are no signs that the cycle will turn anytime soon.

It’s great to see, that 7% of the company is held by employees and average seniority of employees is 10 years. I watched the latest conference call and my impression of management is that they are numbers driven (what I like), pragmatic and very determined.

All in all a great stock for the long term, maybe we will get a good entry point if the recession in the construction industry gets worse before it gets better.

Sto SE & Co. KGaA

Market Cap (MM) 938,20 €

Enterprise Value (MM) 853,63 €

LTM ROIC 16,2 %

LTM EV/EBIT 6,75x

Sto is a german family owned company with a long history that sells paint, plaster and insulation systems to professionals in the construction industry. The KGaA incorporation is special and gives the family full control, similar to an A/B share structure. The long term stock price performance has been solid, but lackluster in the last 10 years:

Long term revenue growth was in the low single digits but peaked at around 10% in 2020/2021 only to revert to the mean last year. The stock is trading slightly below historic price to sales multiples, so the stock performance is more likely to result from better business performance, not a rerating in multiples. The market for insulation in Germany and Europe is huge, but this is a commodity business in a competitive, currently struggling sector. I cannot see that shareholders have a good risk/reward here currently. But to be fair, this company is a solid business with a decent dividend yield, so nothing wrong with owning this stock.

Zehnder Group AG

Market Cap (MM) 588,50 CHF

Enterprise Value (MM) 581,66 CHF

LTM ROIC 19,7 %

LTM EV/EBIT 8,57x

Zehnder Group is a Swiss company that manufactures indoor climate systems in Europe, China and North America. The company is currently struggling, as it sells to the construction industry and sales declined 6% in 2023. The stock actually did not do much in the last 20 years:

If there is no growth, it is hard to create shareholder value in the long term. I will stop here and leave Zehnder to Pension Funds and pure dividend investors.

Fortec Elektronik

Market Cap (MM) 83,86 €

Enterprise Value (MM) 75,48 €

LTM ROIC 18,1 %

LTM EV/EBIT 6,47x

FORTEC is a german small cap that specializes in electronic components, display technology and embedded systems. The company has a long history and went public in 1990, the stock performance so far has been mixed:

The financials look OK, a typical supplier business with revenue in a bumpy uptrend and operating margins in the range of 3%-10%, currently the margins are at an all time high. My concern is that margins might revert to the mean, I have no insight in their moat or the competitive nature of the industry and would consider the company cheap, but probably cheap for a reason.

Laboratorios Farmaceuticos Rovi S.A.

Market Cap (MM) 3.359,62 €

Enterprise Value (MM) 3.370,04 €

LTM ROIC 40,7 %

LTM EV/EBIT 13,39x

Laboratorios Farmaceuticos Rovi is a Spanish company that really did well for investors and delivered a 21% CAGR price return + dividends since 2011:

As far as I can understand, they are a specialist for anticoagulant heparins (well, soe stuff that treats blood diseases) and a contract manufacturer for big Pharma (Merck, Novartis). They were a beneficiary of the Covid-boom, had a short Covid Blues but recovered quite. What strikes me is their recent margin expansion. Historically, they had mid to high single digit operating margins, but could push those to 30% since 2021. So clearly something is going on here, but I have to admit this business is not in my circle of competence.

CEWE Stiftung & Co. KGaA

Market Cap (MM) 697,76 €

Enterprise Value (MM) 734,85 €

LTM ROIC 20,1 %

LTM EV/EBIT 9,08x

CEWE Stiftung operates as a photo service (photo prints and books) and online printing business, mainly in Germany. I profiled them in my SDAX series and they are a rock solid conservative company with good fundamentals and able management. Although they operate in a competitive industry, they managed to survive the disruptive forces of digitalization that drove many competitors in the photo processing and printing space out of business. The long term stock price performance was solid, delivering 8% price return plus dividends.

Revenue declined during Covid but picked up since 2022 and is now in the high single digits. That’s what you can expect from their business and that’s probably the main source of future shareholder returns. I really like the business and the stock, in my opinion this is “growth at a reasonable price” at its best. But unfortunately I did not buy last year when they traded in the 70s. Currently, the company is trading near 52 week highs, so I would wait for Mr. Market to make an interesting offer in the 70-80 range. The stock is on my watchlist.

Brødrene A & O Johansen A/S

Market Cap (MM) 1.589,36 DKK

Enterprise Value (MM) 2.348,93 DKK

LTM ROIC 15,1 %

LTM EV/EBIT 6,93x

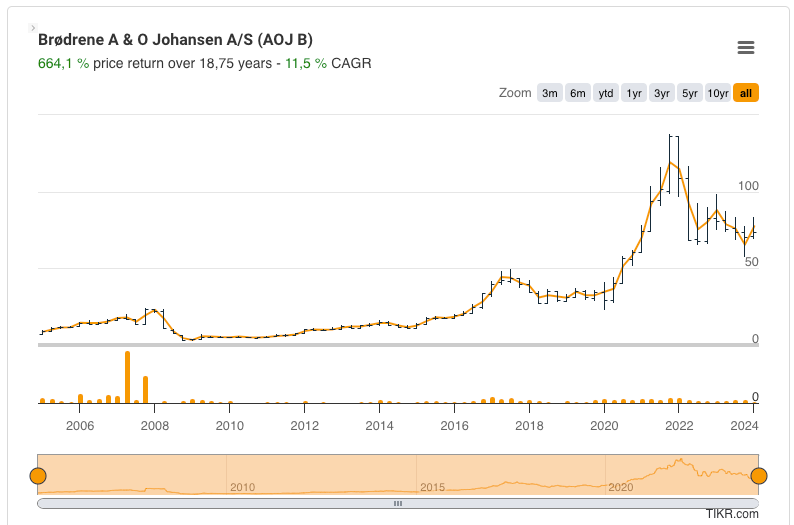

Brødrene A & O Johansen is another value stock that some respected value investors I follow write about and hold. It is a danish, family owned distribution business that sells plumbing and electrical equipment to construction professionals. The stock did well long-term, but it is clearly a cyclical business that can suffer painful drawdowns in a recession, just look at the 85% drop in 2009:

The valuations look incredibly cheap, so some risk might be priced in. On top of the historic double digit price return, you received a nice dividend that is currently at 7%. I glanced at the last annual report and they display a nice owner operator mentality and seem to do business in an innovative and very customer focused way. I do not see much upside in multiple reversion to the mean, this business was historically cheap in the last decade, future returns will likely come from profitable growth and dividends, provided that the Danish construction industry will not fall into recession. This stock is on my watchlist and a clear candidate for the portfolio.

Computacenter plc

Market Cap (MM) 3.263,52 £

Enterprise Value (MM) 3.106,42 £

LTM ROIC 24,4 %

LTM EV/EBIT 11,86x

Computacenter is a British technology and service provider that sells IT solutions and equipment mainly to large corporations and to the public sector. They say about themselves that they are “thriving on change” and the ongoing shift to more digitalization meant a lot of change for their clients, so good for Computacenter stockholders that experienced great returns:

The income statement tells me, that this is more of a trading business than a solutions provider, gross margins are around 12-15% and operating margins are super thin between 1,5% and 5%, almost retail-like. Currently margins are quite high compared to the longer term history. There was crazy growth with up to YoY 28% in in the recent years, but keep in mind that only 10 years ago, this company was growing it’s top line at around 2%, so I see a lot of risk in growth-, margin- and multiple-contraction. A possible tripple whammy in the wrong direction? Too much risk for me at the moment.

WashTec AG

Market Cap (MM) 428,23 €

Enterprise Value (MM) 482,22 €

LTM ROIC 30,0 %

LTM EV/EBIT 10,85x

WashTec is a manufacturer of car wash solutions from Germany and sells mainly car wash “tunnels” to service stations, gas stations and big convenience stores. They have an installed base of 53500 units and are the world market leader:

It is one of those businesses that shows up frequently in my value screens because there is a lot to like:

easy to understand business with limited disruption potential (electric cars get dirty, too)

high returns on capital (30% ROIC LTM)

good free cash flow generation and high dividend yield (6,9% dividend currently)

Recurring nature of business (40% of sales are from service and chemicals)

The stock performance was disappointing in the recent years, so there might be opportunity for a rerating:

The story here is actually quite simple (I like simple): Operating margins contracted from 2017/18 when they were at around 12% to 9% LTM, leading to disappointment and a stock decline. At a recent presentation at Eigenkapitalforum, management stated that they want to grow the top line at 7% and plan to increase the operating margin to 15% until 2030. If they can do that, this is a good investment opportunity with low risk and double digit compounded return. I found an interesting interview with management (in german) from the respected value blogger Jonathan Neuscheler, who is bullish on the stock.

In summary, I think this is a good business at a fair price where management has a credible plan to increase sales and margins:

Management and other insiders bought some stock recently at higher prices:

Unfortunately, overall insider-ownership is still very low and there is no owner operator culture. I personally really like the business and the near term growth prospects and strongly consider to open a position in WashTec.

I hope you liked this series. I think Joel Greenblatt’s magic formula helps a lot when it comes to “fishing in the right pond”. So much research can be a waste of time, but I had the feeling that I was indeed fishing in the right pond. However, I also had the impression that many companies pass the screener because they trade at peak margins and peak revenues in cyclical industries, so a combination of a quantitative approach (screening results) and a qualitative approach (fundamental analysis/qualitative filters) might deliver the best returns here.

In the weeks to come, I want to dive deeper into some of the companies that I find interesting and add a handful to the portfolio. Stay tuned if you are interested.

Safe investing,

Michael

Disclaimer

Nothing on this substack is investment advice.

The information in this article is for information and discussion purposes only. It does not constitute a recommendation to purchase or sell any financial instruments or other products. Investment decisions should not be made with this article.

The information contained in this article is based on generally-available information and its accuracy and completeness cannot be assured.

Investments in financial instruments or other products carry significant risk, including the possible total loss of the principal amount invested.

Regarding AOJ: I like the fact the ceo is not receiving SBC, but many other senior employees.

Thank you, very much appreciated