Magic formula stocks Europe part 1

ROMGAZ, Somero Enterprises Inc., Prevas AB, Funkwerk AG, New Work SE, Clasquin

ROMGAZ

Market Cap (MM) 18.500,28 RON

Enterprise Value (MM) 17.291,51 RON

LTM ROIC 43,3 %!

LTM EV/EBIT 3,29!

ROMGAZ is a natural gas producer and supplier in Romania that made it on the magic formula list because it is obviously a beneficiary of skyrocketing gas prices in Europe. The current cheapness, measured by an EV/EBIT of 3,29 and the profitability measured by a ROIC of 43,3 % is absolutely striking!

However, profitability was weaker until 2016 and increased dramatically since 2022. So I assume, that normalized numbers will look a little bit different and are a function of political and macro-economic developments. This was actually the kind of stock I wanted to avoid. Additionally, 70% of shares outstanding are owned by the Romanian government. Therefore, I will pass.

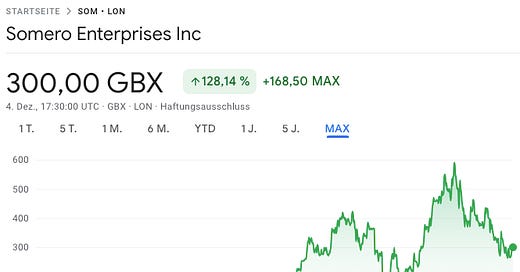

Somero Enterprises Inc.

Market Cap (MM): 162,70 £

Enterprise Value (MM): 144,53 £

LTM ROIC: 47,9 %

LTM EV/EBIT: 5

This stock is a really interesting find and the whole exercise was worth it just because I stumbled over Somero! This seems to be a very well run company that manufactures and sells very specialized construction equipment that is used for concrete leveling. Many companies need super flat concrete in their warehouses or production facilities, and that is what Somero machines can do very well. It is a US company, listed in the UK, which could explain the discounted price. Their main business is in the US. They are addressing concrete contractors and promise them faster, flatter and more profitable results!

It is obviously a niche market, their product video on youtube has only 11.500 views in 7 years. The video is fun to watch, though:

My first doubt was: Is this a one hit wonder? But after checking the figures, I am really impressed that they have such consistent high returns on capital:

And stable margins with rising revenues until last year. H1 2023 saw a steep decline in revenues by 14 % compared to last year.

Since this company sells to the construction industry, there is a cyclical element to it. After some reading, I found out that they had a near-death experience in the GFC in 2008/2009 which can be seen in the long term chart. Equity holders were more or less wiped out. Since then, they avoid debt.

In the last trading outlook, they project a healthy non-residential construction market and further growth in Europe and Australia, but the main business in the US is declining rapidly (-24%) at the moment. Unfortunately, there is not much insider ownership. Earnings and dividends will probably be volatile in the near term. I am reluctant to invest, because the equipment manufacturing industry has a bad reputation for high competition, low returns on capital and low profitability. In this case, the numbers speak for themselves, but I admit I have not yet understood the source of the competitive advantage and the durability of the moat of the company.

In my opinion, this is a very interesting company and a close watch for the patient investor that can stomach some volatility due to the cyclical construction industry.

A reader notified me about a write-up about Somero on the Hidden Value Gems blog, check it out.

Prevas AB

Market Cap (MM): 1.421,44 SEK

Enterprise Value (MM): 1.421,04 SEK

LTM ROIC: 34,9 %

LTM EV/EBIT: 5,74

Prevas is a technical consulting company from Sweden. The stock did nothing from 2005 to 2019 and then went up 8-fold.

They have good returns on capital because since they are a consulting firm, they have low capital investment needs. The high earnings yield is a consequence of rising revenues and margin expansion since 2017. Growth is half organic and half by acquisition, but the acquisitions did not result in an over-leveraged balance sheet. Shares outstanding went up by 30% from 2020 to 2022, so there was significant dilution. All in all, this company looks really interesting and I like the combination of profitable growth and cheapness.

It looks like margins are reverting to lower levels at the moment. Since their big success story is only 5 years old, I need to understand better the “why” behind this outstanding performance and would need to put in more work.

A close watch for now.

Funkwerk AG

Market Cap (MM): 166,84 €

Enterprise Value (MM): 132,44 €

LTM ROIC: 30,6 %

LTM EV/EBIT: 4,96x

Funkwerk AG is an interesting german company that is a hot tip in the german small-cap world. There are great write-ups about the company from respected value bloggers like Augustusville and Intelligent investieren (german). Please check them out for more in depth information, there are also some very interesting comments below the article in the Augustusville Blog!

The company manufactures train radio systems and passenger information systems and had a long history of disappointing performance, until the new CEO Kerstin Schreiber took over in 2014. She refocused the product portfolio and achieved outstanding performance, growing revenues and expanding margins at the same time. She has an “underpromise, overdeliver” reputation. The balance sheet is super strong, there is net cash and they pay a small dividend.

The main issue is, that 78% of shares outstanding are owned by Hoermann GmbH and that Funkwerk recently acquired another subsidiary of Hoermann, named Hoermann KN for 19,4 MM EUR, clearly a related party transaction and a substantial cash transfer from the daughter to the mother. On top of that, the transaction price was not disclosed to shareholders until the annual report came out 9 months later. This is not exactly good governance. Let’s hope, Hoermann does not plan to dump more unloved assets on Funkwerk.

I do not expect further margin expansion, more a “reversion to the mean”, but that is more than priced in at current stock price levels. Their end market seems to benefit from long term tailwinds and investments in the railway infrastructure, so a reasonable single digit growth rate can be projected.

All in all, this looks like a great investment for the patient small-cap investor that believes, that the market is wrong on the “Hoermann-discount”. I personally strongly consider buying the stock, because I think it has all the characteristics of a winner and the margin of safety is there at the current stock-price of around 20 EUR.

New Work SE

Market Cap (MM): 395,68 €

Enterprise Value (MM): 355,40 €

LTM ROIC: 31,4 %

LTM EV/EBIT: 5,35x

This stock is an old friend. I bought it around 2009 and sold in 2012 for a small gain, only to watch the stock go up 8-fold, poor timing. I recently wrote a little bit about it in my SDAX series. Since then, the market cap has more than halved and the stock has had to leave the SDAX index!

The long term stock chart does not look very appealing, during the last 4 years, the stock lost 80% of its value:

The main reason for the decline is multiple and margin compression, growth has slowed down from double digit to zero on TTM basis. On a QoQ basis, revenue is already in decline 4%. The old cash-cow “Xing”, a social network for professionals (a LinkedIn for the german speaking world) looks like a melting ice-cube and needs to reinvent itself. The last investor presentation says, they will reposition Xing from a social network to a jobs network, whatever that means. They also own some other interesting assets, the Kununu platform, a European glassdoor and Internations, a network for expats.

Unfortunately, I could not find detailed disclosure on social network key metrics. They report members (20 MM) and new members yoy (0,7 MM), but I could not find metrics about active users like monthly active users (MAUs) or daily active users (DAUs). My assumption is, these metrics would not look too glamorous… Many people I know have an account on Xing, but did not log in for years. I personally canceled my paid plan years ago since I could not see value or a return on investment and recently I paused for a year (I actually wanted to delete, but the app “nudges” you towards pausing).

Anyway, their future revenues will not come from billing members for their membership (they call that B2C), but from billing recruiters and companies that are looking for employees. I really cannot foresee how that will play out exactly, there seems to be so much competition in this space with all the legacy job platforms like monster, stepstone and indeed. But I can see a future and some kind of niche for them.

What I like about the situation here:

Extremely capital light business model. No debt! Revenues are billed upfront, they have more than 100MM unearned revenue on the balance sheet. This company cannot go broke!

The valuation (5x EV/EBIT) looks like a no brainer

Good returns on capital

Very bad sentiment for the stock, forced selling because of index exclusion

But there are some things that should be considered:

The german publishing house Burda owns a controlling 50,02% stake in the company, they are not famous for innovation and platform business expertise. A takeover is unlikely.

The company capitalizes some of their development costs. Nothing excessive, but earnings are a bit inflated in my opinion.

Declining revenue meets shiny (legacy?) startup culture, I am not sure if management is aware of the hard steps necessary. It is a lot more likely, they will further blame the economy, Covid and other stuff and will continue to overpromise and underdeliver for some quarters. I think they eventually need a new management that is willing to make hard cuts and adapt to the new reality.

Corporate headquarters look like there is still some fat to be trimmed:

I would wait a litte bit on this one. The thesis here for me is a possible multiple rerating and profitability increase under a new management.

Clasquin SA

Well, we are late to the party on this one, unfortunately. Clasquin is a great company in the interesting industry of freight forwarding. The shipping and logistics giant MSC recently proposed a takeover that resulted in a 40% share price increase.

Since I do not want to do merger arbitrage, the stock is not interesting for me. Kudos to the magic formula for bringing up this opportunity. It might be interesting to look at the freight forwarding industry in general, since some other stocks like Expeditors International also did really well long term.

That’s it for now, I enjoyed the first 5 stocks from my magic formula exercise and am looking forward to the next batch!

Disclaimer

I currently do not hold an investment in the securities mentioned, but that can change anytime.

Nothing on this substack is investment advice.

The information in this article is for information and discussion purposes only. It does not constitute a recommendation to purchase or sell any financial instruments or other products. Investment decisions should not be made with this article.

The information contained in this article is based on generally-available information and its accuracy and completeness cannot be assured.

Investments in financial instruments or other products carry significant risk, including the possible total loss of the principal amount invested.

Good job! I am really interested in some of the companies you mentioned. Specially I looked few months ago at somero enterprises.

Let’s see how it all goes! Keep doing great work.

Great article, many thanks for providing this. I think running a magic formula scan in Europe is still a way to discover a bunch of interesting companies. New Work has been on my list for some time, but I shall also look more deeply into Somero and Prevas.

Personally not a big friend of commodity exposure, so Romgaz would be no priority for me. Clasquin is interesting as a merger arb situation. Many thanks for referencing my Funkwerk piece.