Magic Formula Europe stocks part 3

SA Catana Group, Edizili Acrobatica S.p.A., Bucher Industries AG, Krka d.d., Piscines Desjoyaux SA, Dr. Martens

Here we go with the next batch of magic formula stocks from Europe:

SA Catana Group

Market Cap (MM) 162,24 €

Enterprise Value (MM) 131,51 €

LTM ROIC 24,3 %

LTM EV/EBIT 5,38x

The Catana Group is a manufacturer of Katamaran boats from France under the brands Catana Catamarans and Bali Catamarans. The boats look really nice and one day, I would like to sail on one of these!

The company was not such a good investment though. They IPOed in 2005 and performed horribly until 2017! Since 2017, revenues are growing strongly, margins are improving and the business was able to generate 15,8% operating margins in 2022.

I personally think this was a margin peak and this business is the definition of discretionary spending, who really “needs” a nice Katamaran? I would avoid such a stock, even if it scores well in the magic formula. The good score is a look in the rearview mirror, their future can be quite different than the recent past.

Edizili Acrobatica S.p.A.

Market Cap (MM) 108,18 €

Enterprise Value (MM) 108,89 €

LTM ROIC 32,6 %

LTM EV/EBIT 7,15x

A company with an interesting history that specializes in outdoor construction work using ropes instead of scaffolding, saving time and money. The founder Riccardo Iovino, used to travel the world by sailboat and learned the rope technique performing maintenance works on the masts of boats. He transferred his knowledge to the construction industry and founded Edizili in 1994.

Sadly, the founder passed away suddenly last year at the age of 58, it is unclear how this will affect the company, since he was the driving force behind it’s success.

It is a small company with an even smaller free float, since 73% of stock is held by the holding company of the founding family and his business partner. I found an interesting and enthusiastic writeup from Sven Lorenz, a respected value blogger.

The narrative here could be, that Edizili will continue to consolidate a highly fragmented market with their franchise approach and turn into a McDonalds of rope based building services. I was a little worried when I looked into their balance sheet, their accounts receivables are ballooning and currently are standing at 90 MM €, 2/3 of total assets! Cash flow is negative. I wonder what will happen to the dividend.

Nevertheless, the case looks interesting. On the negative side, there is massive key person risk after the death of the founder, the business has low barriers to entry, the company has yet to prove that it can survive a serious recession in the construction sector and is very dependent on the regulatory framework.

Bucher Industries AG

Market Cap (MM) 3.642,52 CHF

Enterprise Value (MM) 3.435,62 CHF

LTM ROIC 24,8 %

LTM EV/EBIT 7,26x

Bucher Industries is a machinery company based in Switzerland and offers a wide array of machines that are used in harvesting, food packaging and street cleaning. It is a very international company with manufacturing facilities around the world. The share performed very well since it’s IPO and delivered a 8,3% CAGR with dividends on top. The current dividend yield is 3,6%.

This is a “solid citizen” kind of stock with low debt, consistent double digit return on capital and only minor hiccups during economic downturns. The last negative ROIC was in 2009 after the GFC.

Currently is a difficult time for the company, order intake is down 15% YoY and inventory is piling up on their balance sheet.

There is 35% insider ownership and I think if your are looking for a solid stock that is cheap and pays a reliable and rising dividend, Bucher could be interesting.

Krka d.d.

Market Cap (MM) 3.525,47 €

Enterprise Value (MM) 3.018,64 €

LTM ROIC 21,8 %

LTM EV/EBIT 6,48x

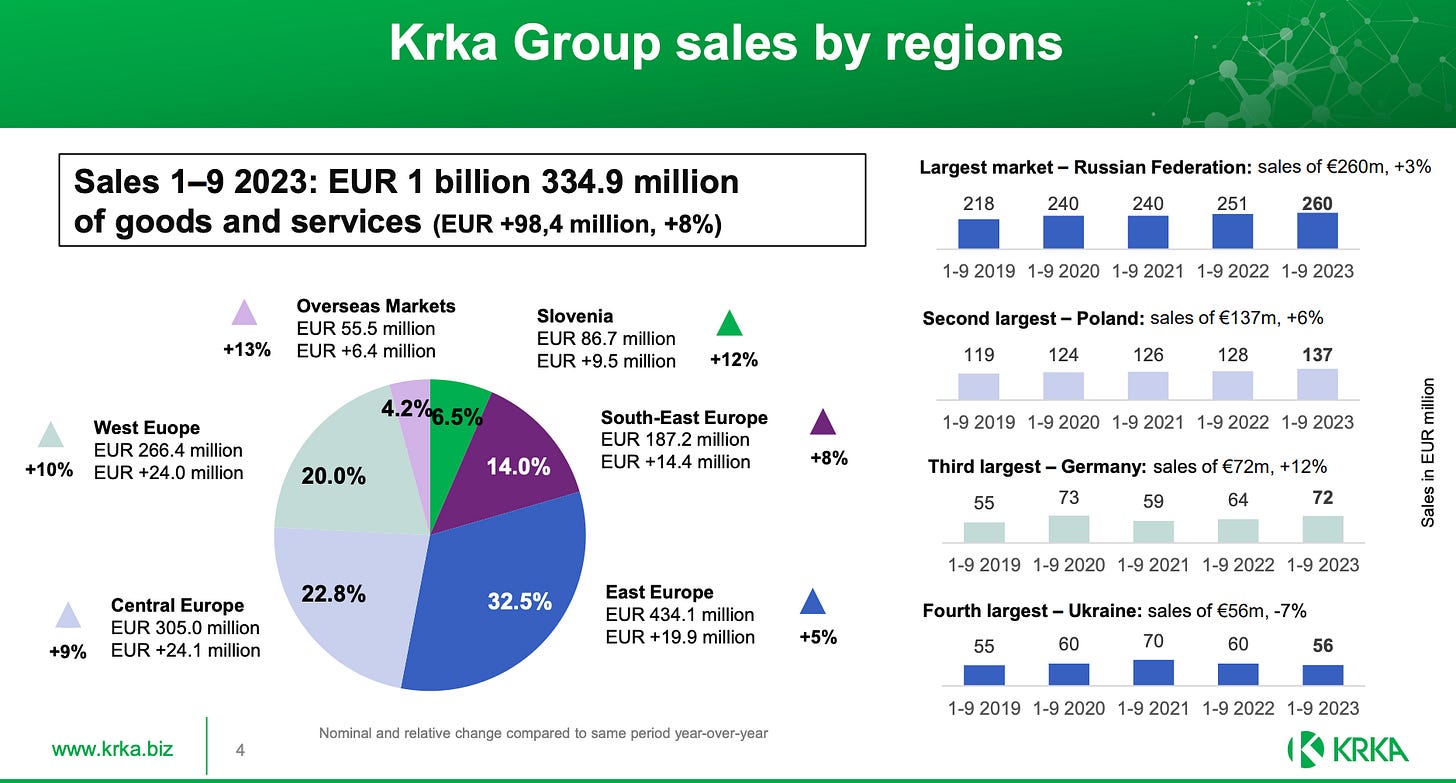

Krka d.d. is a company from Slovenia that produces and distributes generic pharmaceuticals. Their business is competitive and global but they seem to do really well. Return on capital is consistently high, there is lumpy top-line growth between 1% and 12% per year, but no down year since 2017. The operating margins are strikingly high between 10% and 25%, which indicates a high level of operational efficiency! Currently there seems to be a margin peak that I expect to revert, which would not be catastrophic at current valuation levels.

The numbers tell me that this is a quality company with slow but reasonable 5% growth and a nice shareholder yield of 10-12% (growth + dividend). Peers like Sandoz or TEVA trade at higher multiples. A possible reason for the cheapness could be their regional focus, the largest market is the Russian Federation, this could cause problems if the war escalates.

All in all a nice “under the radar” company with a stable business, a nice shareholder yield but a lot of Russia-risk.

Piscines Desjoyaux SA

Market Cap (MM) 138,21 €

Enterprise Value (MM) 101,76 €

LTM ROIC 13,3 %

LTM EV/EBIT 4,73x

This company is a french microcap that sells swimming pools and all the related materials that are necessary to maintain such a pool. At first glance I consider the market to be quite interesting: A swimming pool is not a one time purchase for the owner, but a continuous obligation to service and maintain it, so there might be some “subscription-like” characteristics.

The long term chart that goes back to 2005 indicates, that this company is not immune to recessions due to its discretionary product. There was a painful 80% drop during the GFC. The last 10 years were profitable though.

The company only provides financial information in french, so a good opportunity to brush up my french from school decades ago. Revenues were flat from 2010-2015 and then rose steadily, culminated in a typical Covid-beneficiary peak and are currently on the decline.

They sell mainly to the french market and some European countries:

Unfortunately, I could not find a breakdown or segmentation of revenues, it would be interesting to know how much of the revenue is of recurring nature.

This really looks like an interesting company in a growing end market, maybe it could be the next “Pool Corporation” of Europe, but I hesitate to put more work into it because of the language barrier.

Dr. Martens

Market Cap (MM) 714,07 £

Enterprise Value (MM) 1.190,07 £

LTM ROIC 18,7 %

LTM EV/EBIT 7,18x

Well last but not least we will cover the good old brand of Dr. Martens! In my teens I was a customer and wore their boots. Well, look what private equity has done to this iconic brand:

The company was taken public by Permira in 2021 at the peak of the last market frenzy and declined 83% since then. Oh boy, poor shareholders.

The company has operational issues with a distribution center, sales are below forecast and inventory is piling up. What I read in some comments is, that they overstretched their pricing and alienated their traditional retail partners. Maybe the private equity playbook is not the right concept for a “punk” brand?! I personally think there will always be a niche for them and they will be rediscovered once in a while by a new generation of teenagers, but they will not become the Burberry of shoes with Apple-store like brand shops, direct to consumer strategy, etc.

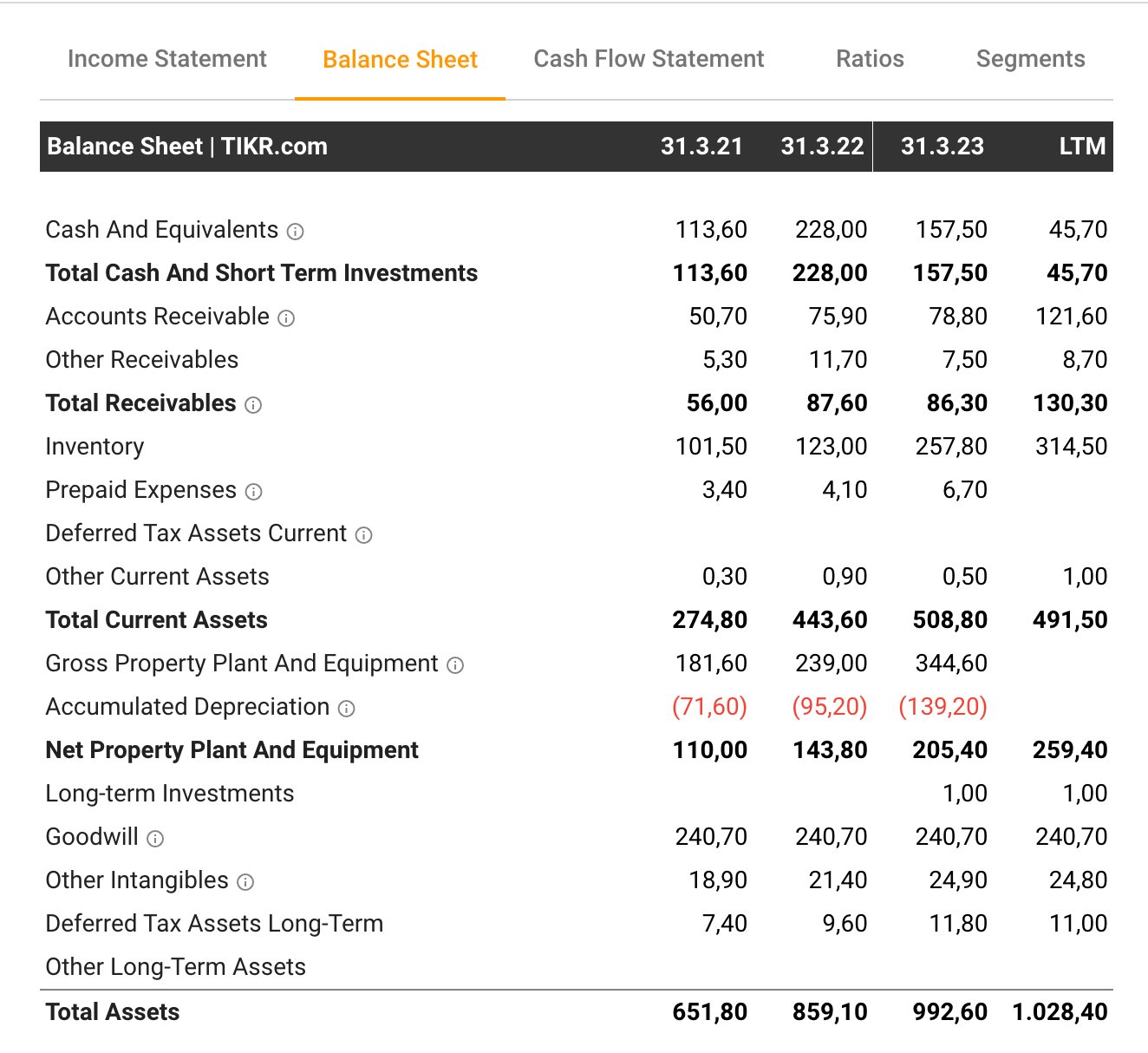

Their balance sheet is a perfect example of a struggling manufacturer:

cash balance went down from 157MM to 45MM

receivables went up from 86MM to 130MM

inventory was high at 257MM, but went even higher to 314MM

So basically, literally half the market cap is now shoes in their warehouses and they are struggling to collect their bills, probably retail sales channels are also stuffed with shoes?

This is a risky turnaround play. Or a private equity déja vu, probably they will be bought out again at current prices, repositioned and in 5 years time, when we all have forgotten about this one, there will be another Dr Martens IPO?

Disclaimer

Nothing on this substack is investment advice.

The information in this article is for information and discussion purposes only. It does not constitute a recommendation to purchase or sell any financial instruments or other products. Investment decisions should not be made with this article.

The information contained in this article is based on generally-available information and its accuracy and completeness cannot be assured.

Investments in financial instruments or other products carry significant risk, including the possible total loss of the principal amount invested.

There is a lot to like about Doc Martens, but as you say the sales forecasts for them are not ideal

I wonder if they will double down on the direct to consumer strategy or go back to relying on retail partners

Krka is a nice defensive business. So far it seems they managed Russia well, get most money out, at close to official exchange rates (ie Bloomberg). RUB Hedging not possible anymore, though.