Quick pitch

Hermle is an archetypical old-school German machine building company with many virtues and little weaknesses. I think it is overlooked because it is boring and the products (milling machines) are not very relatable. BUT it has a very long and successful operating history, shows outstanding returns on capital, good margins and very conservative management with a long term focus.

We can currently buy preferred shares of this company at a reasonable absolute valuation and a record low relative historic valuation. High single digit EPS growth, a 5% dividend yield and a potential multiple expansion should lead to double digit returns in a 3-5 years time frame.

I will start my analysis with some key metrics:

Let’s have a look at the long term stock performance. The good thing is, that long term stockholders were rewarded with a 12% CAGR. But recent performance looks lackluster and this company is not recession immune:

The company

Maschinenfabrik Berthold Hermle AG was founded in 1938 in Gosheim, Germany and specializes in milling machines that are used in a wide range of industries, as they say “from medicine to auto racing”. Their slogan “milling at its best” says it all, they are really passionate about their products and produce high performance machinery, are a constant innovator and provide reliable service for their customers.

The company was set up as a mom and pop screw manufacturer in 1938, went into the milling machine business in the 1950s and constantly evolved in the last decades into the hidden champion they currently are. In 1990, they raised capital and started trading publicly on the stock exchange with their preferred shares.

The company has a reputation for being very product driven, conservative and economical. Think executives with ties from the 90ies, a functional but non-shiny headquarter, an anti-woke, very traditional company culture with long tenures, a good treatment of employees but no gender quotas or gender speech. They are not trying to please the capital markets either. There is no investor presentation, no capital markets day, no adjusted EBITDA, no shenanigans whatsoever.

The products are heavy duty machines for milling that look like this:

Company culture

What I particularly like about Hermle is the company culture. They seem very pragmatic, business-focused and rational. One example is their “breathing company” approach where they try to adapt to cyclical business conditions with very flexible working conditions for employees. As I understood the concept, employees have good job security and are not fired in a recession but work less hours and will have to work longer hours when the business is booming. A practical and rational answer to the problem of cyclical demand.

Another example that I read about: As demand in the US peaked in 2022, they unceremoniously sold all their demo machines, resulting in an unexpected revenue boost in 2022.

They rarely use debt to finance investments but fund investments from operating cash-flow.

These are little hints that form a picture of a rational and pragmatic company that I want to invest in.

Business model and moat

The business model of Hermle is the high end german machine builder business. They produce all their machines in Germany and export worldwide. Their success depends on several key elements:

Quality Technology and Precision Engineering

Hermle is synonymous with quality, precision and reliability in the machine construction industry. Their machines are engineered to deliver exceptional accuracy, reliability, and performance. This precision engineering is a cornerstone of their business model, catering to industries where precision machining is critical, such as aerospace, automotive or medical technology. Constant innovation and quality control is needed to stay ahead of the competition. This focus on quality enables Hermle to maintain a reputation for excellence and have pricing power and higher margins.

They focus especially on automation solutions that lead to higher output per worker, this should be a good market in the future when worker shortages become more and more problematic.

Customization and Flexibility

Hermle offers a range of machining centers that can be customized to meet specific customer requirements. In the end, the machine is a tool for their client to produce bespoke products. This customization capability allows them to cater to diverse applications and industries.

Global sales, service and support

Their extensive network of sales and service partners ensures efficient distribution and support, enabling them to penetrate various markets. Hermle's business model emphasizes providing excellent service and support to customers throughout the entire lifecycle of their machines. This includes comprehensive training, technical assistance, maintenance services, and spare parts. By offering reliable support, Hermle aims to build long-term relationships with customers and enhance their satisfaction and loyalty.

A moat that needs to be constantly defended

So all in all, this is a good company that is nevertheless active in a competitive market and constantly needs to make good decisions and smart investments in its future to keep and protect its moat. So far, this was achieved successfully, but we need to monitor if they stay on the right path.

The machine building industry has a reputation for being competitive and cyclical. Hermle cannot escape this reality but has done a good job in the past, as we can see in their constant profitability, good margins and good returns on invested capital.

Management, Incentives, Ownership

The top managers are all long-time employees, one of them is from the Hermle family.

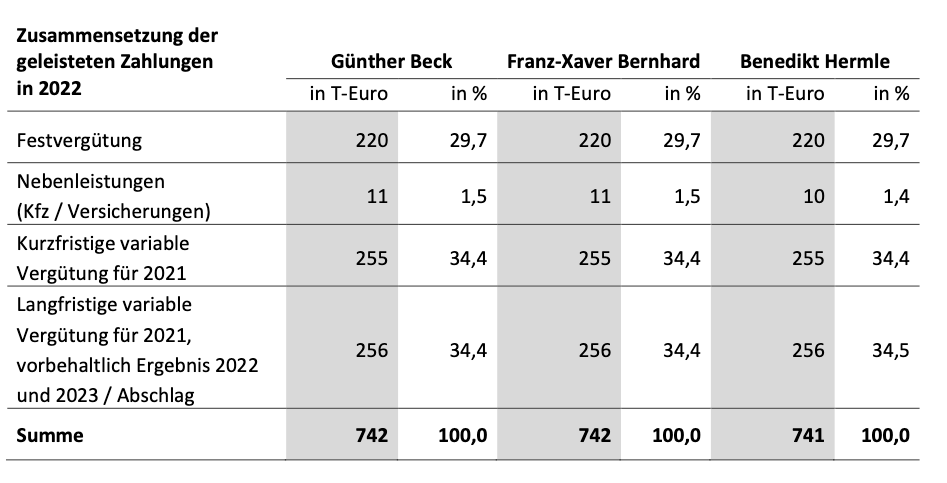

Their compensation is quite good, and a lot of it is performance based:

The base salary is 220 K EUR plus bonuses for short term and long term performance. In 2022, they made 742 K EUR each in total. The performance based compensation is based on reported net profit and has a cap. They each get 0.4% of net profit of last year plus 0.4% of net profit of the rolling last 3 year period. So all in all, around 2.4% of net profit goes to management. These are not “peanuts” and management is not altruistic, but this is nevertheless a good alignment with shareholders and incentives drive behavior, so I am OK with that.

Only the preferred shares are listed, the voting shares are all controlled by the family and long term associates. So far, they treated shareholders well.

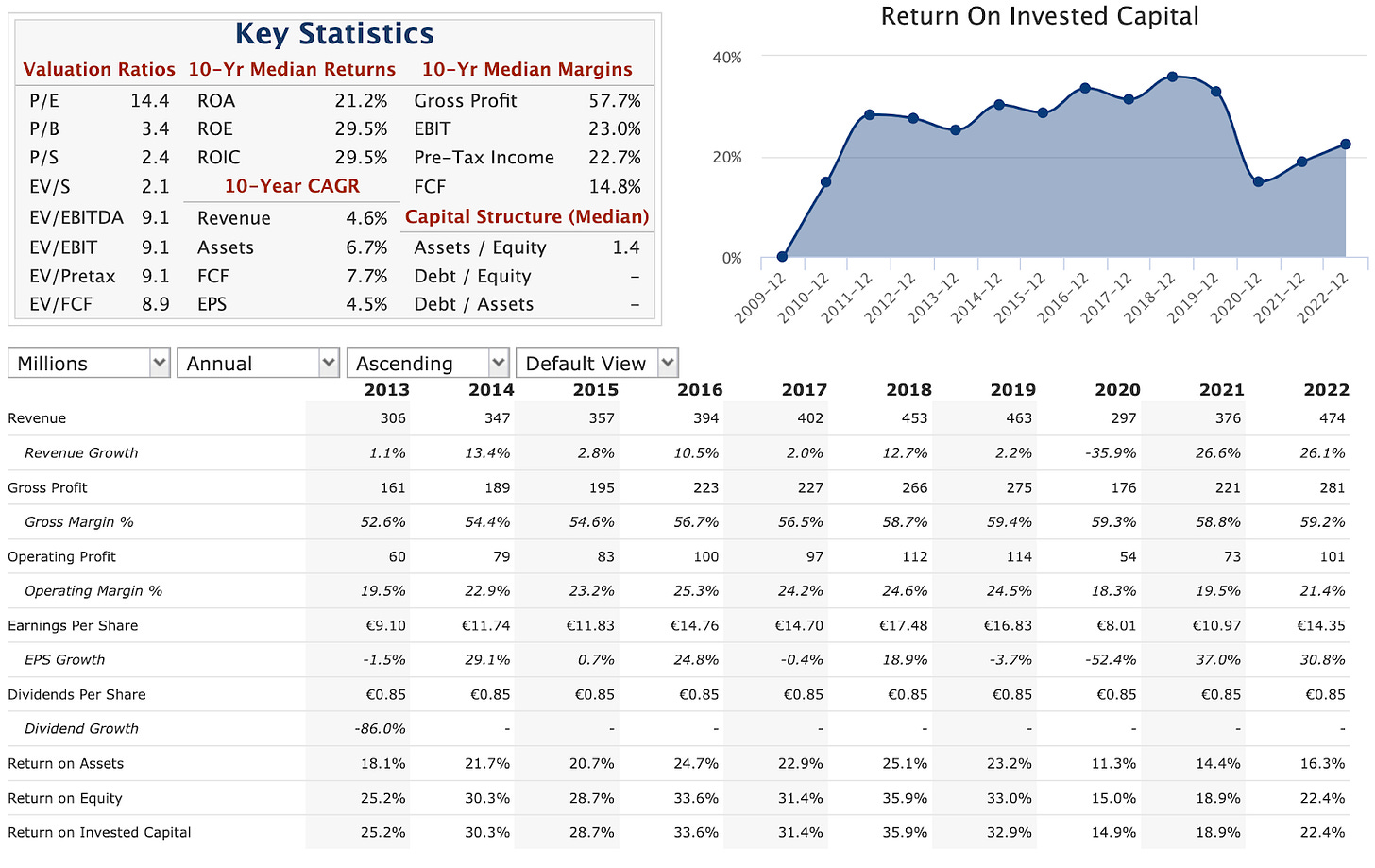

Key numbers from QuickFS:

Revenue is quite cyclical and not recession immune (see COVID 2020-2021), but clearly growing nicely over the cycle

ROIC, ROE and margins are remarkably stable and good!

Valuation

My conservative estimate of intrinsic value is significantly above the current price, the margin of safety is 20% in my opinion. Not an excessive undervaluation, but given the quality of the company, the downside risk seems to be limited. In my bear-case, the company is fairly valued. I think the chances for a permanent loss of capital are minimal, if there is a recession we can expect volatility, but this business should survive and maybe even come out stronger.

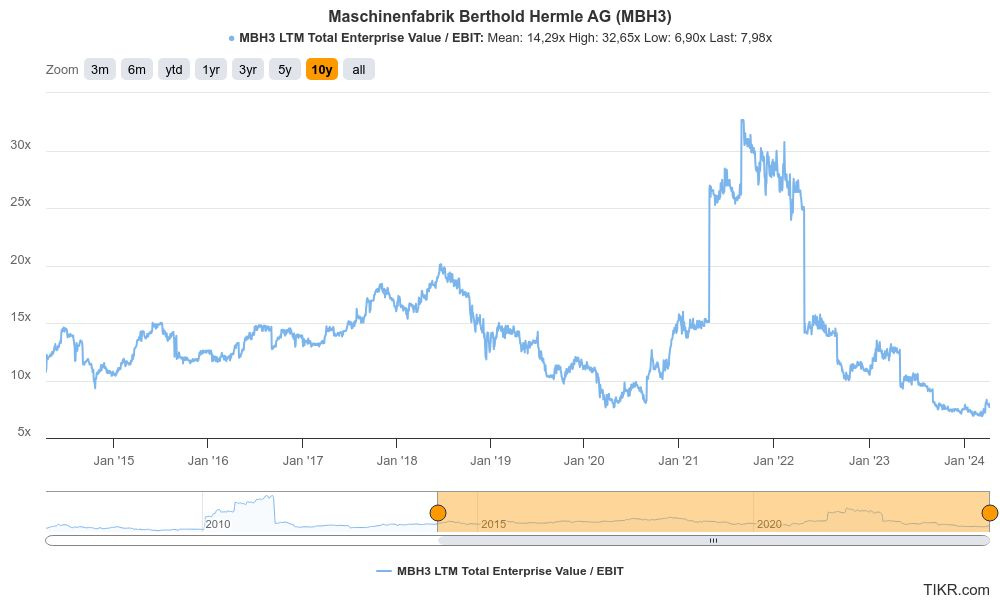

The basic historic valuation metrics look good, there is multiple expansion potential. The stock is trading at record low P/S multiple of 2.16, the mean P/S of 3.3 alone is an upside of 50%!

The EV/EBIT multiple is under 8, a rare opportunity:

Risks

A recession will impact sales volumes significantly, this can never be ruled out and the question is when, not if. In the GFC in 2009, their revenues were cut in half, but they remained profitable! The order intake in 2023 declined 7% and the last press release was cautious. We will have more information in the annual report that is scheduled for the end of april. But in the long run, their products will be in demand and the company should be able to recover, especially since it has no debt.

Competition could erode their moat and pressure margins and returns. I am not an industry expert, so I will probably not be the first to know.

Finding good staff is a growing issue in Germany, but they seem to have a great company culture and invest a lot in employee training and education. So this should be manageable.

Disruptive technologies like 3D printing could make milling obsolete in the very long term. But this is just a wild low probability guess of mine, I have no deep knowledge of the industry and could not find a real threat when I researched the trends in the milling industry.

Conclusion

This is the opposite of a hot stock and I do not expect spectacular returns. But on the other hand, we have the opportunity to invest in this high quality company at an attractive entry multiple of around 8x EV/EBIT. Future growth in the high single digits, a 5% dividend yield and some possible multiple expansion should lead to satisfactory index beating returns in the low double digits with very limited downside risk. This company is well run, has no debt and their products are high quality and the stock is currently out of favor. I will give it a go and allocate around 3% of my portfolio to the stock.

Disclaimer

I do hold an investment in the issuer's securities.

Nothing on this substack is investment advice.

The information in this article is for information and discussion purposes only. It does not constitute a recommendation to purchase or sell any financial instruments or other products. Investment decisions should not be made with this article.

The information contained in this article is based on generally-available information and its accuracy and completeness cannot be assured.

Investments in financial instruments or other products carry significant risk, including the possible total loss of the principal amount invested.

Like the write-up - thanks. Why is the ROIC down from the 40s to now around 20%?

Great piece, thank you for this. I pretty much agree that this has been a compounder over the years of years which however is somewhat cyclical and currently trading at cyclical low - a setup I generally like and have invested in.

We have a number of these boring family-owned hidden champions in Germany, many of which are not public, but still there are enough to build a portfolio from. These tend to execute well, do not care about financial markets much, are conservatively financed, have no imminent catalysts and normally let me sleep well. The thing is that nothing ever happens, but I agree that normally, over a 3-5 year time horizon, a (low) double-digit return (say 12% p.a.) is in the cards. But you have to be patient and just hold.

Hermle is in that bucket, I would also suggest Nordwest Handel and Funkwerk (I own both) and maybe Eurokai (written up on Valueandopportunity) is also a candidate.