Investment thesis

ANGI is a US public company that is currently 85% owned by IAC, the company builder of the renowned investor and entrepreneur Barry Diller. The 85% stake will be distributed to IAC shareholders via a Spin-Off on 31.3.2025.

ANGI was a disastrous investment for IAC so far. The shares trade at all time lows, down 92% from their peak in 2018. The current sentiment is bad, everybody is in the red and the numbers look terrible at first glance. The company is currently in restructuring mode and revenue shrank double digit in 2023 and 2024. On top of that, a recent regulation by the FCC (Federal Communications Commision) has a negative impact on lead aggregators like ANGI and will further depress revenues, so we might see the low point in 2025 (more on that later). At first glance, this setup smells like toxic waste, not like opportunity.

But there are also positives: The company has a solid balance sheet and a credible plan for a turnaround and growth.

Most importantly and key to the investment thesis: The current CEO of IAC, Joey Levin will take the role of executive chairman at ANGI and will lead the company post Spin-Off. He owns sizable equity (5MM shares) in the company. Joel Greenblatt taught us that it pays to pay attention to insider activity in special situations.

The company and its business model

ANGI is a lead aggregator that connects homeowners and contractors and charges a fee for leads of prospective clients. The international brands include ANGI in the US, MyHammer in Germany, Travaux in France, Werkspot in the NL. The company started in 1995 as a simple directory for local businesses and contractors. It IPOed in 2011 at 13$ and subsequently crashed due to bad operational performance.

IAC acquired a majority stake in 2017 and merged it with its own lead aggregator HomeAdvisor.

The business model is simple, the contractors are the paying clients, the homeowner leads are the “merchandise”. The basic challenge of lead aggregators is to acquire home-owner leads cheaply via SEO/SEM/brand awareness and monetize those leads in an effective and value adding way. This business model needs good execution and smart management that is not fixated on growth at any price. You can easily grow revenue by paying Google 25$ for a lead and reselling it for 20$, but do we as investors want that?

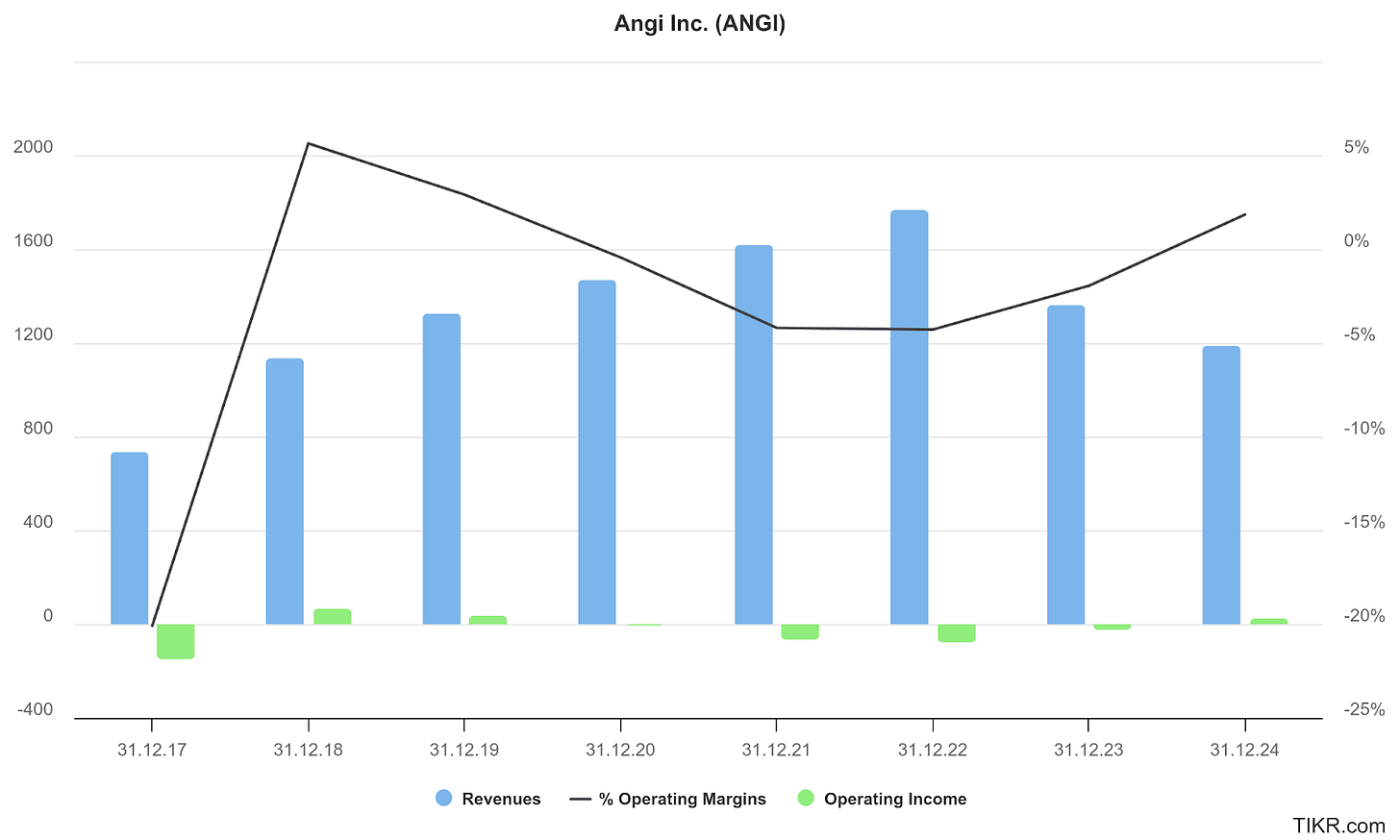

Until the recent pivot to profitability, the business performance was first promising, and then really bad:

The business flipped to profitability in 2018 and at the time, this might have looked like operational leverage and this was when the share price peaked.

But that optimism was short-lived. In the subsequent years until 2022, it was clearly unprofitable “growth at any price” and operating margins went south and bottomed at -5% in 2022. ANGI was in a crisis.

Management was replaced and Joey Levin, at the time CEO of IAC took over as interim CEO of ANGI in October 2022. The company subsequently cut costs and discontinued unprofitable business segments and has turned profitable again.

To make matters worse, the FCC (Federal Communications Commision) issued new rules in 2023 that prevented lead aggregators such as ANGI from collecting information from one homeowner and then selling that information to multiple contractors. Up to then, these websites connected one homeowner to many contractors, without special consent. The new rules said, home owners need to consent separately for each contractor, to prevent robocalls and robotexts. That means a lot of change in the business model, the old model incentivised platforms to sell a lead as often as possible, to the detriment of the home-owner. ANGI has reacted promptly and implemented an opt-in for every contractor. Lately, this rule was vacated by the FCC, but ANGI said in the last conference call, it is committed to the changes because they benefit the customer. As a result, leads will be of higher quality for contractors but ANGI needs to adapt its pricing model as leads will be sold less often.

The issue was mentioned in the last shareholder letter and conference call and ANGI sees a staggering ”low 20s percentage” drop in revenue but an improvement in customer satisfaction and matching seems to be more effective with the new system:

I see this as a temporary headwind that will eventually have a neutral or slightly positive impact on the business. Why? Because the change is clearly beneficial to the long term business model and market forces will lead to higher prices for contractors and/or lower acquisition costs at Google. The platform is now better aligned with the interests of the home-owners and customer experience will be better in the future, which is good.

Management, Incentives

Joey Levin, former IAC CEO will lead the company post Spin-Off as executive chairman. He owns 5MM shares and I expect him to increase his stake. I consider him to be a good and trustworthy businessman, he knows ANGI inside out because he served as IAC CEO since 2015 and was ANGI CEO from 2022 to 2024. He is taking considerable career risk here and him taking over ANGI is a bold move. But as Barry Diller said, “Joey wants to have his own store…” There is nothing like entrepreneurial spirit!

Jeff Kip is the current CEO of ANGI and a good executive, he led the international operations successfully since 2016 (the grew double digit consistently) and took over from Joey in 2024 as CEO. He owns roughly a million shares and I expect him to increase his stake as well.

I think management has shown that it is committed to profitable growth and is aligned with shareholder interests.

The past, the future and return expectations

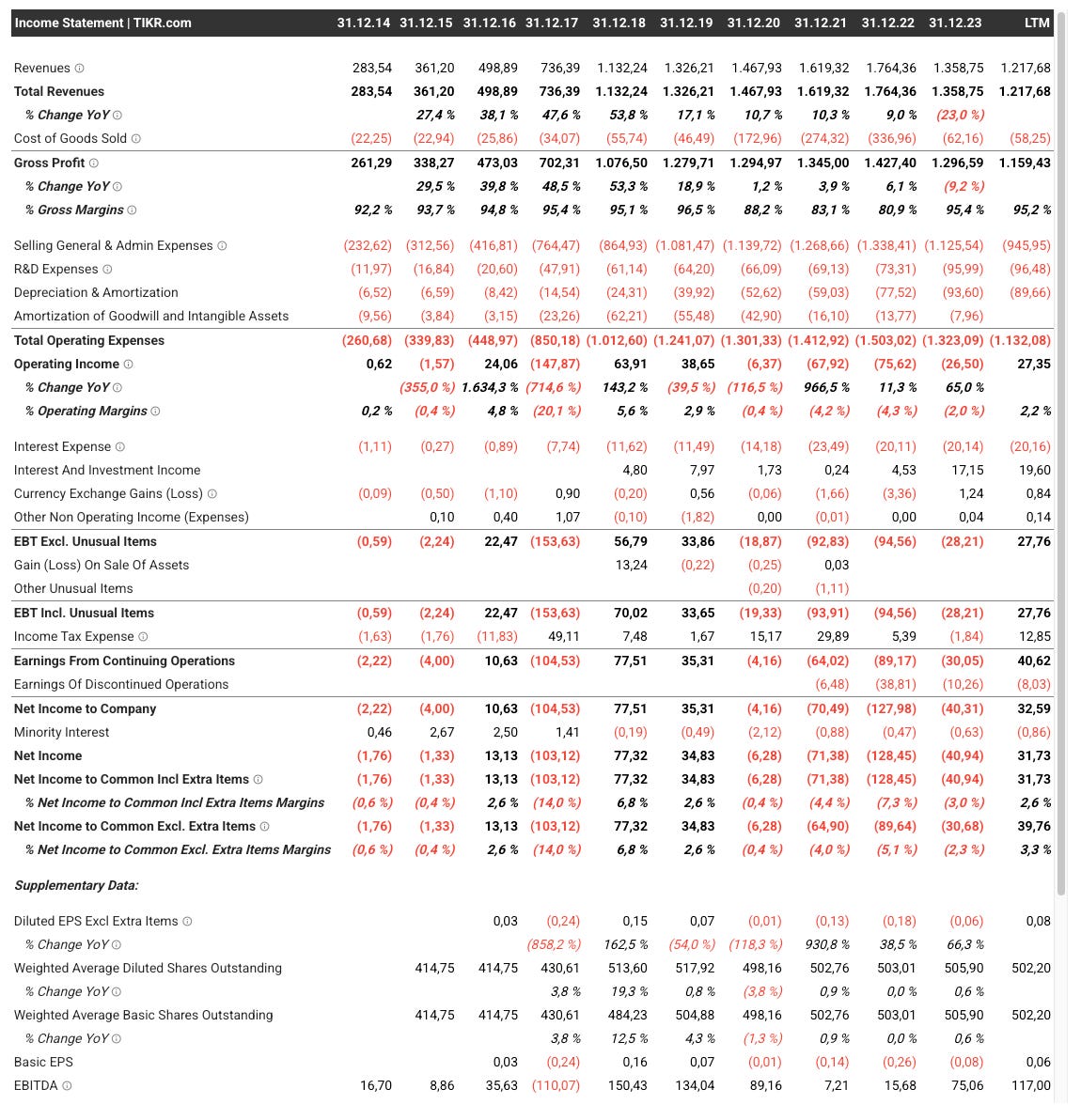

The numbers of the last 3 years do indeed look ugly:

The good news is, this can be fixed. By its very nature, a lead aggregator like ANGI can be a decent (although not stellar) business. Barriers to entry may be low (anyone can build a website, sign up contractors and bid on Google keywords), but well known brands such as ANGI, MyHammer or Werkspot have good organic Google rankings and long lasting relationships with contractors and at least some network effects. I assume, long term, they should be able to earn at least a 8-10% operating margin and grow above GDP because this market is not fully penetrated yet and as more and more millennials become home-owners, this should help adoption of web platforms for home services.

As an example, a top notch lead aggregator with outstanding management like the Moltiply group, an Italian business that makes comparison websites for insurance, credit, telephone contracts etc. is even capable of earning 13-20% operating margins, so it’s not impossible, although the two businesses are not 100% comparable.

The good thing is, that the turnaround at ANGI is already happening and visible, the bad thing is that the sales low-point will be in the future, in 2025. My basic expectations for business performance are as follows:

the balance sheet will stay as strong as it is, with a net cash position

revenue will bottom in 2025 at roughly 920-950 MM $

revenue growth YoY from 2026 and ongoing in high single digits/low teens (8-12%)

cash-flow stays positive, profitability improving further

operating margin improvement to 8-10% in 2028

stock based compensation will be reigned in (already happening 37 Mio LTM -> 20-10 Mio in FY 2025, the lower the better)

A free cash flow shareholder yield of +10% in 2026, enhanced through growth, operational leverage and buybacks/share count reduction in the future

I asked myself, what will the ANGI P&L look like in 3 years time? This is my back of the napkin calculation:

1,3 Mrd $ revenue

200 Mio $ EBITDA

90-110 Mio operating income

Deserved EV in my opinion roughly 8-10x EBITDA or 2x the current valuation.

Including opportunistic share buybacks and a possible 15-20% share count reduction in the meantime, I assume the stock has room to double or triple from current levels. If we can buy stock even cheaper due to a sellout post Spin-Off, the return expectations are even higher.

Conclusion and game plan

I already bought a 0,3% starter position in ANGI (currently down 20%).

The Spin-Off date is planned for 31.3.2025.

ANGI has 497 MM shares outstanding. 85% (422,5 MM) are owned by IAC and will be spun to IAC shareholders.

IAC has 86,27 MM shares outstanding, so each IAC shareholder will receive roughly 4,9 shares for every IAC share.

ANGIs balance sheet will remain strong, 416 Mio cash and 500 Mio bonds will stay with Angi post Spin-Off, which was confirmed by Barry Diller in the last conference call.

I expect a lot of volatility post Spin-Off and very probably the stock will be sold off and bottom 3-6 months after the Spin-Off date in late summer 2025 due to indiscriminate selling of IAC shareholders that are just not interested in ANGI and will press sell for this small position of “found money”. We will see, but maybe Mr. Market creates an interesting buying opportunity. I acknowledge that this is a more volatile and speculative investment. But volatility and future price developments could turn ANGI into a “one foot bar” investment, say at $1,20 $ a share and below, I will add heavily to the position.

Bottom line: This is a bet on the new ANGI management. The insiders understand the situation better than we do, and Joey Levin, the CEO of IAC will be the new executive chairman of ANGI. So, the most important insider wants his stake in ANGI and so do I!

Disclaimer

I do hold an investment in the issuer's securities.

Nothing on this substack is investment advice.

The information in this article is for information and discussion purposes only. It does not constitute a recommendation to purchase or sell any financial instruments or other products. Investment decisions should not be made with this article.

The information contained in this article is based on generally-available information and its accuracy and completeness cannot be assured.

Investments in financial instruments or other products carry significant risk, including the possible total loss of the principal amount invested.